برای تغییر این متن بر روی دکمه ویرایش کلیک کنید. لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است.

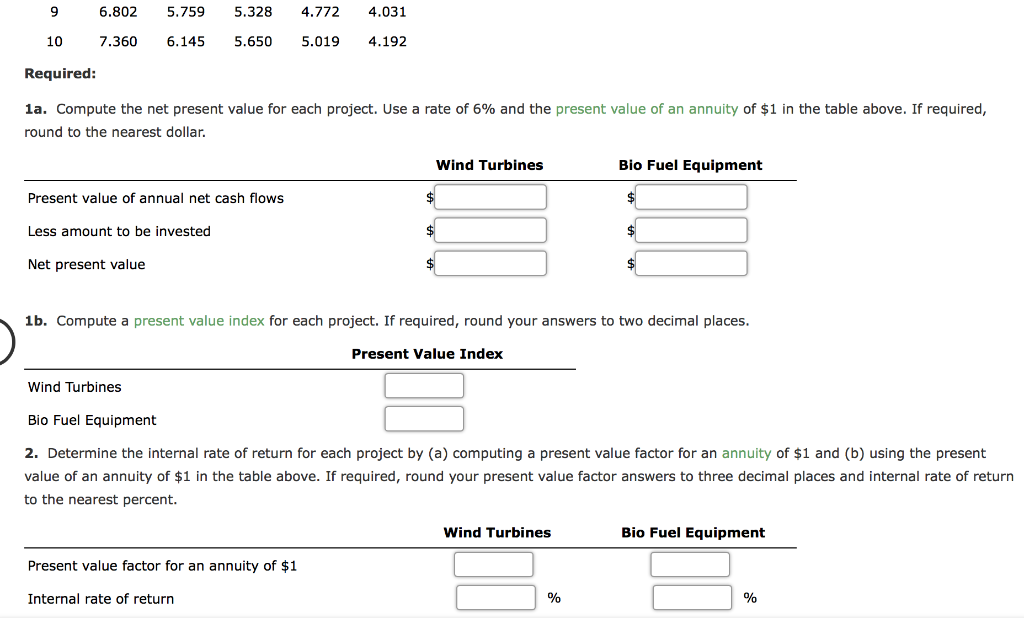

So it results in which have a credit history with a minimum of 600 and you may a deposit of around step 3.5%, regardless of if fico scores may actually getting somewhat lower to your proper down payment. When you have straight down ratings, imagine good FHA mortgage to have poor credit, however you might need more 3.5% down seriously to of-put the chance on the bank. This type of money remain the best alternatives for anybody lookin to safer a loan and you can transfer to their fantasy family.

FHA home loan financing restrictions from inside the Ca change based individuals housing versions and you may regional houses will set you back. These FHA loans was tailored for borrowers facing challenges in making good-sized down costs.

During the 2024, California educated a notable rise in its FHA loan restrictions, getting a new limit cap out-of $498,257 for unmarried-family relations land, $637,950 for two-friends functions, $771,125 for three-relatives services, and you may $958,350 to have five-family unit members functions. BD Nationwide can help you recognize how FHA financing California limits functions.

Areas like Los angeles, Bay area, San diego, Lime County, and you can Santa Clara was some of those and you’ll discover increased FHA loan limits. the latest San diego condition loan limitations 2024 enjoys grown significantly.

A year, it assesses several key factors: the prevailing conforming antique loan constraints while the average home prices inside particular section. From the referencing the fresh federal compliant mortgage restrictions place from the Government Property Money Institution, the latest FHA set a unique floor and you will ceiling constraints.

FHA funds stand out since a leading selection for basic-go out homebuyers, giving greater the means to access versus Conventional fund. So it wide qualification makes them very preferred among varied individuals into the Ca, courtesy the lower down commission and credit history criteria, and the method of getting financial help possibilities.

Yes. There are many different acknowledged FHA lenders that offer FHA finance to possess bad credit which have ratings as low as 580.

In the 2024, the new Federal Homes Administration (FHA) mortgage limits to have Tangerine Condition, California are set at the $766,550 having lowest-balance fund and you will $step one,149,825 to possess higher-equilibrium finance to the unmarried-device properties. Such Orange County loan restrictions echo new area’s median house price, with increased in recent years. Mortgage brokers exceeding $1,149,825 are known as jumbo fund and don’t be eligible for FHA financial support otherwise antique loans away from Federal national mortgage association or Freddie Mac.

In 2024, the brand new FHA financing limitations to have La State is actually $1,149,825 for large-balance money and you will $766,550 getting reduced-balance funds, one another relevant so you’re able to unmarried-tool features. These types of constraints are prepared by Institution regarding Property and you may Urban Invention (HUD) and are generally adjusted a-year so you’re able to reflect alterations in property philosophy. The rise within the California’s FHA loan constraints to have 2024 are a good a reaction to the brand new nation’s ascending home values. BD All over the country helps you find out the principles and you may FHA mortgage criteria Los angeles.

Single-family: The brand new maximum for the majority of areas was $766,550, showing an effective 5.5% boost away from 2023. However, during the highest-costs counties particularly Los angeles, Contra Costa, and Tangerine County, the brand new restriction are $step one,149,825. Two-unit: New maximum is $981,500, with San francisco bay area County that have a high limit out-of $1,472,250. Three-unit: The restrict is $step 1,186,350, whilst in San francisco bay area Condition, its $step one,779,525. Four-unit: The new limit try $step 1,474,400, having San francisco bay area County’s limit put within $2,211,600.