برای تغییر این متن بر روی دکمه ویرایش کلیک کنید. لورم ایپسوم متن ساختگی با تولید سادگی نامفهوم از صنعت چاپ و با استفاده از طراحان گرافیک است.

Predatory lending may use the sort of car loans, sub-perfect money, domestic collateral money, taxation refund anticipation money otherwise any sort of consumer debtmon predatory lending practices were failing to disclose information, disclosing false information, risk-oriented rates, and you can excessive charge and you may fees. These types of strategies, often yourself or when joint, manage a cycle from financial obligation that triggers big financial hardship to possess family and individuals.

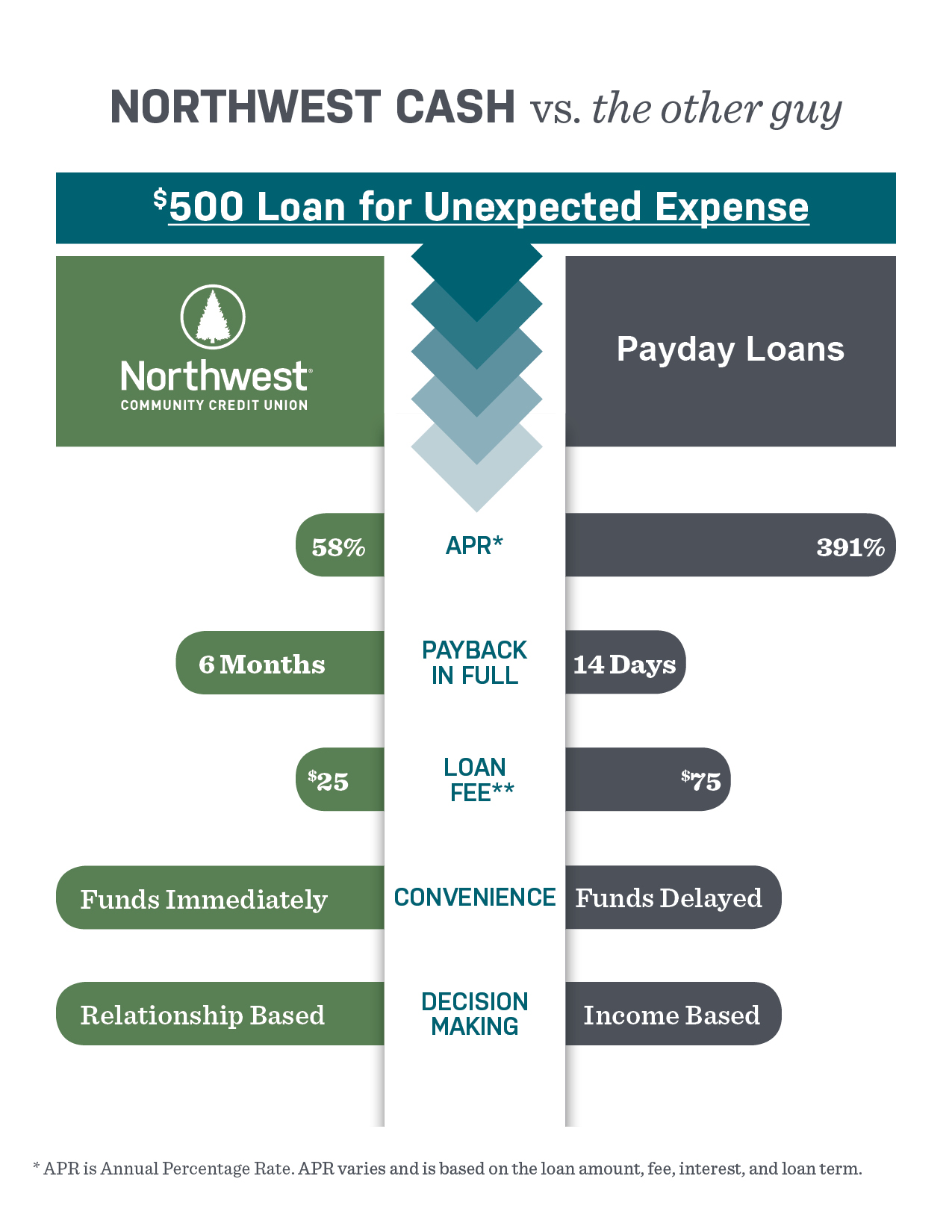

If you find yourself facing loans dilemmas, you can even think these loan providers try their simply solution. Untrue-you have got plenty of solutions so you can taking out a premier-costs financing:

Sooner, you need to know that you will be responsible, even although you become when you look at the financial hardships. There are numerous selection to eliminate large-rates borrowing out of predatory lenders. Take time to speak about the options.

Is actually this post helpful? Visit all of our It’s A financing Question home-page for much more brief films and you may of good use articles to help you seem sensible of your own money, that topic at the same time! See right back, brand new subject areas might possibly be brought continuously.

Run-down and you will bare domiciles ? the newest unavoidable result of predatory financing ? wreak havoc on neighborhoods. Possessions values slip. Anyone move out. Shortly after strong neighborhoods begin to break, following crumble. A thing that has been so important getting a lot of people lies from inside the spoils. Group whom stayed in a district missing from the predatory credit will get a target.

Competitive solicitations. Did somebody sell to you personally? Be suspicious of whoever found you selling you a loan. If you like financing, shop around for it oneself.

Balloon Costs – A common predatory habit is to try to bring good bower that loan having straight down monthly installments with a giant commission due within stop of your mortgage term. Fundamentally, a beneficial balloon payment is over 2 times the newest loan’s mediocre payment per month, and regularly it can be thousands of cash. Repeatedly such balloon costs is hidden in the deal and sometimes catch consumers by the treat.

If you are offered that loan towards pledge in advance you are going to feel acknowledged, feel most cautious. If you’re given that loan no advance payment, be sure to comprehend the regards to the loan also if or not you’ll encounter a first mortgage an additional loan with other rates and when you are needed to pay for mortgage insurance rates?

Since the predatory money are secured loans, the lending company has actually something you should get if the borrower defaults. So, of the deceiving one into the taking out that loan to own a good domestic they can not manage, a loan provider will have money getting a time and up coming get the possessions right back throughout foreclosure and sell it to possess a revenue.